Traditional vs. Roth IRA: Which Is Right for You?

Even if you’re still early in your career, chances are you’re already dreaming of a great retirement. But what’s the best way to save up for the retirement income you’ll need in the future?

Whether you’re just starting to save or you want to take your retirement saving up a notch, an individual retirement account (IRA) could be a smart solution.

IRAs are one of the most popular retirement savings options around, and it’s easy to see why. While employer-based retirement plans like 401(k)s offer tax advantages and the potential for long-term growth, today’s workers (who often change jobs with greater frequency than in the past) often like the flexibility of a retirement account that isn’t tied to their workplace and provides more investment options.

Offered by financial institutions like BluPeak Credit Union, IRAs provide an accessible way for eligible savers to take advantage of tax breaks while growing their savings.

What Is an IRA?

An IRA is a tax-advantaged retirement account for people with earned income. You can set one up yourself through a financial institution rather than your job. One of the biggest benefits of an IRA is that it’s yours to control – you can decide what assets you invest in, from low-risk savings options like IRA term certificates to investments like stocks, bonds, and mutual funds.

The biggest drawback of an IRA is that your employer doesn’t make contributions; you put in all the money yourself. However, there are some key benefits, including the opportunity to take advantage of tax breaks now or later (depending on the IRA), as well as the deferral of taxes on earnings, which helps your money grow faster.

For the 2020 tax year, you can contribute up to $6,000 into a Traditional or Roth IRA. People age 50 and up can make an additional “catch-up” contribution of $1,000 per year. Making the maximum annual contribution will help you take full advantage of the IRA’s savings and tax benefits.

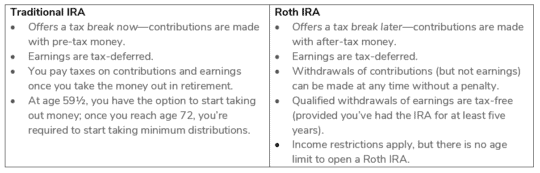

While IRAs have the same annual contribution limits, there are key differences between Traditional and Roth IRAs. Let’s take a look.

Keep this in mind: There is a 10% IRS penalty for taking an early withdrawal (before age 59 ½) from a Traditional IRA, with certain exceptions. If you put money into a Traditional IRA, you’ll want to keep it there until you’re eligible to make qualified distributions.

For a Roth IRA, that 10% penalty applies to early withdrawals of earnings only (not contributions). Also, Roth IRAs let you avoid having to take a required minimum distribution at any point, meaning that you can continue to leave the money growing in the account during retirement, and you can even transfer the money to a beneficiary after you die without tax consequences for them.

Which Is Right for You?

When choosing between a Traditional and Roth IRA, the most straightforward answer is this: If you expect to be in a lower tax bracket later in life, it makes financial sense to contribute pretax income to a Traditional IRA, so you’ll have more money to invest now and a lower tax rate later. Conversely, if you anticipate paying a higher tax rate in the future, contributing after-tax money into a Roth IRA could help you reduce your tax liability down the road.

Many financial experts are most enthusiastic about the Roth IRA because of its ability to give you tax-free withdrawals of qualifying contributions and earnings along with valuable estate-planning benefits for you and your family.

It’s a good idea to talk to a financial advisor and tax expert about your specific situation. There are many rules and nuances related to Traditional and Roth IRAs—too many to touch on here—so you’ll want to have a knowledgeable advisor by your side.

Start Saving Now (You’ll Thank Yourself Later)

As with any retirement planning strategy, time is your greatest advantage. Thanks to the magic of compounding, setting aside even modest amounts each year in a Traditional or Roth IRA can support significant growth when you allow enough time for earnings to accumulate on top of previous earnings.

Let’s Build the Retirement of Your Dreams

Thinking about a retirement plan, but not sure where to start? Here at BluPeak Credit Union, we offer a variety of resources to support your retirement goals, including financial advisors [link to investment services page], IRAs and helpful retirement planning resources.

Consult a tax professional regarding your individual tax situation. This content is for informational purposes only and is not intended to be financial or investment advice. Consult a licensed professional for financial planning and investment advice.